Latin America is in demand and stands out as a travel destination. UNWTO forecasts that Latin America will receive 78.2 million tourists by 2027, generating US $82 billion for the local economy. LATAM countries are influenced by a strong domestic travel market, followed by tourists from North America and Europe, plus an increasing number of Chinese travellers.

To get a better picture of the current tours and activities landscape in Latin America, TrekkSoft conducted a survey in April 2019. 165 tour and activity operators took part in the survey providing us insights into their tourism businesses, their target group and market and what role technology plays in their everyday operations.

Findings from our tourism survey 2019

For our Latam Tourism Survey in April 2019, we had 165 participants from 15 different Latam countries, mainly from Peru (18.5%), Mexico (16.7%), Colombia (13%), Chile (12.3%) and Ecuador (8.3%).

32% of participants are running (half) day tours, 26% were multi-day tour operators, followed by travel agents (17%), DMO/DMCs (9%) and 5% resellers. The majority of these companies had around up to 5 employees (62%).

Customers are mainly domestic tourists, travelling from the surrounding LATAM countries, followed by European and North American tourists.

Driving booking channels

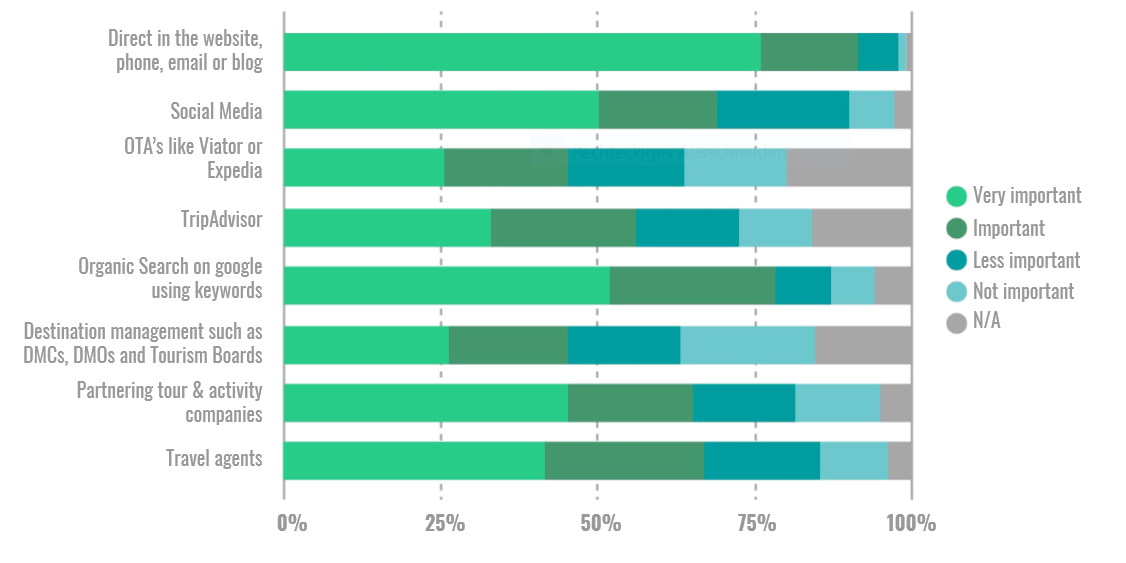

For tour and activity companies there are different ways of addressing customers and getting bookings. As part of a balanced distribution strategy we at TrekkSoft always suggest not to be dependent on one single channel, but aiming for an equalized sales strategy based on direct and indirect bookings.

For our survey participants the most important sales drivers for their businesses are direct via their own website, phone or email (75%), followed by Social Media (46%) and Google Search (45%). Less important drivers are Destination companies like DMOs, tourism boards or DMCs and online travel agencies.

Technologie use in LATAM

61% of the survey participants offer a booking option via their own website. This aligns with the results from our Tourism Survey 2018 where 64.6% are actually offering a booking option on their website, compared to our Industry Research from 2016 where only 53% offered it via their own website.

Key trends in the Latin American market

#Last minute bookings

165 participants of the LATAM tourism survey stated last minute bookings as #1 trend with 54%. TrekkSoft booking data shows that reservations for tours and activities which last 1 to 3 hours tend to be booked in-destination or just before arrival. Multi-day tours and activities however, are made in advance or upon arriving at the destination.

When it comes to tours and activities, last-minute bookings are common. From our data, we found that bookings are generally made 13 days in advance. However, for bookings made on mobile, the window narrows to just 5 days between the booking and the trip itself.

#Chinese Outbound market

So far South American countries were not number 1 travel destinations for Chinese tourists due to visa restrictions and logistical challenges. But it is consistently evolving to appear on the Chinese travellers map.

According to Dragon Trail 2019, most Chinese tourists traveling to South America visit Brazil, Argentina and/or Chile, but other countries are seeing significant and sustained growth as well.

All these countries have mentioned a significant rise in Chinese travellers over the last couple of years - even though the proportion of Chinese tourists compared to other nations is still low.

#Sustainability

In the LATAM tourism survey 2019 almost 80% of attendees stated that sustainability plays a major role for the tourism industry in general and their business particularly. In our LATAM Travel Trend Report 2019 we present some sustainable initiatives.

#Mobile bookings and payments

Customers are comfortable researching, booking and planning their entire trip to a new travel destination on a mobile device. Mobile devices also lead to a greater propensity to book at the last-minute. Google Data shows that travel-related searches for “tonight” and “today” have grown over 150% on mobile, over the past two years.

Read more about the Latin American market and its trends in our new published LATAM Travel Trend Report 2019: