By understanding the coming year’s booking trends, travel professionals can make strategic choices to double down on strengths and pivot towards rising markets and booking channels to make 2018 a real success.

Following the success we’ve had with our Travel Statistics Report, we’ve published our newest edition with an even more in-depth look at the year ahead. You can get your copy now:

To share a preview of what we cover in the travel trends report, here's what we're noticing about how, when, and where travel consumers are booking.

Where are consumers booking tours and activities?

82% of tour & activity bookings are on provider websites

82% of all tour and activity bookings processed by TrekkSoft take place on a company’s website or mobile app.

For the other 18% of TrekkSoft bookings, 13% happen via agents. The remaining 5% are via marketplaces and point of sale, such as through the TrekkSoft Point of Sale Desk or Mobile App.

The use of online travel agents is growing

Although OTAs like Viator and Expedia drive around just 4% of all tour and activity bookings according to separate TrekkSoft and Phocuswright data, this is growing. Phocuswright predicts that the market share of OTAs will double by 2020.

Suppliers using TrekkSoft get most bookings through Viator, which drives 87% of marketplace bookings. The next biggest channel is Expedia, with 13% of marketplace bookings.

Read more: Our take on the opportunities to go after in Phocuswright's "Global Travel Activities 2014-2020: Tours & Attractions Come of Age"

More bookings are happening on mobile, with less device switching to desktop

With online tours and attractions gross bookings expected to more than double from $9B in 2015 to $21B in 2020, most of those online options will be mobile-optimized (Phocuswright).

More consumers are staying on mobile to book instead of device switching. After researching on their smartphone, 79% of mobile travellers in 2017 completed a booking. That is a significant increase on the 70% who did so in 2016 (Google).

For tours and activities, the proportion of bookings completed on mobile is lower, but it’s growing year-on-year.

49% of tour & activity bookings are on mobile

Nearly half of direct online bookings are now on mobile, compared to 31% in 2016 (TrekkSoft).

It's vital that tourism websites are mobile-optimized, especially if you're a destination or tour operator selling bookable experiences. To reach your audience in-destination, mobile can also be a great place to target your digital ad spend.

Read more: 9 ways mobile has changed travel (and what tour and activity operators can do about it)

Who is booking tours & activities online?

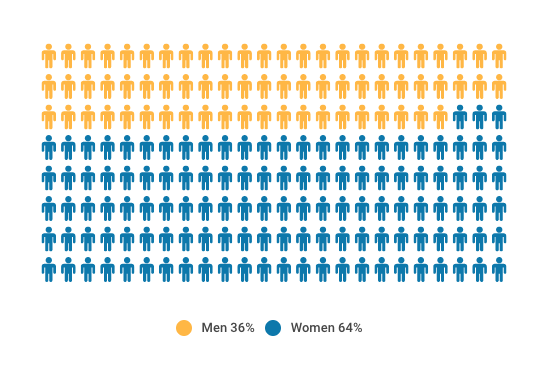

Gender & booking online

For some time, we’ve known that women are researching and booking the majority of holidays. Our data from the TrekkSoft platform shows that this also applies to tours and activities:

64% of tour & activity bookings are made by women

Data: Gender of customers booking via TrekkSoft, Q4 2016 - Q3 2017

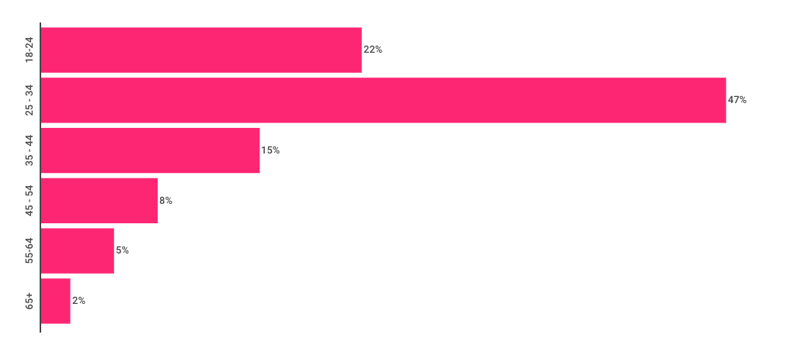

Age & booking online

69% of consumers who book a tour or activity via TrekkSoft are aged 34 or younger. Within this age range, the majority of bookings are made by 25 to 34 year-olds.

The smallest proportion of bookings are from older generations - just 8% of our bookings come from customers aged 45 to 54, and 7% are aged 55 and above.

Data: Age of customers booking via TrekkSoft, Q4 2016 - Q3 2017

For more insights, get your free copy of the 92-page Travel Trends Report 2018 now.

Want to get your activities found and booked by more customers in 2018? You're in the right place.