This is an excerpt from our latest Travel Trends Report 2020/21 in collaboration with Arival. Download the report to get a full analysis of the year to come, as well as practical strategies for operators to consider in the coming months.

In 2019, the tours, activities and attractions sector was valued at $254 billion. Before the pandemic hit, the sector was expected to grow by 23% in 2020. Since the pandemic brought the entire world to a halt, the sector's future seems less clear.

What can tour, activity and attraction providers expect in the coming months as we enter 2021?

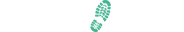

The Road To Recovery Is Long and Windy

Given the uneven and uncertain route to recovery, experts at Arival do not expect the segment to return to pre-Covid levels before 2023. Even with the market more than tripling from 2020 to 2022, revenue will only reach 81% of 2019’s total.

However, there have been pockets of notable business performance:

- Growing summer travel within domestic markets, as well as some European cross-border travel.

- Increased demand for outdoor and adventure experiences such as water sports and national park hikes where social distancing is more easily implemented in the experience.

- Increased demand for private or self-guided experiences that limit interaction with large groups of people.

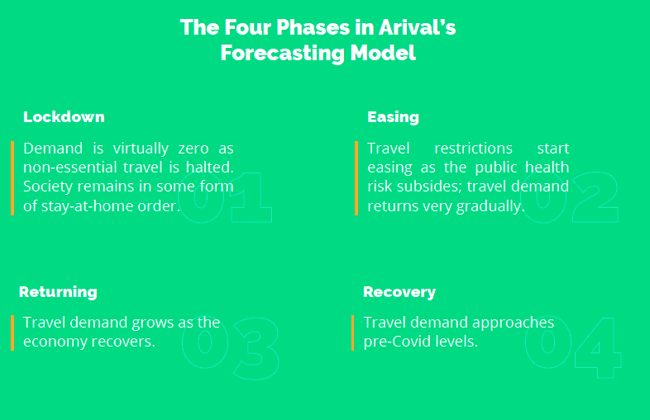

Booking Trends During The Pandemic

At TrekkSoft, we saw that the tour and activity providers using our booking software were hit with a raft of cancellations. In January 2020, when awareness of the virus’s spread was relatively limited to Asia, our customers issued 5.4 times as many refunds compared to January 2019. The trend accelerated in February as it became clear that Covid-19 was spreading globally. Refunds issued that month reached a jaw-dropping 7.2 times the volume of February 2019.

By March, cancellations were no longer the big story because bookings had dropped to historic lows, down 75% compared to the prior month. In April, we processed just 1,000 bookings across its network of approximately 900 providers.

But while the virus will continue to limit travel, a key ingredient for recovery is proving resilient: Travellers’ thirst for experiences. In June, we saw small signs of recovery when the volume of bookings processed jumped 400% compared to May.

Digital Trends For Tour, Activity and Attraction Operators

1. Acceleration of digital adoption

Before the pandemic, many operators did not see the value of investing in a digital booking system. At the same time, purchasing habits pre-pandemic were mostly done offline.

That said, 2019 bookings from online channels grew more than twice as fast as offline. This shift has largely been driven by:

- Consumer behaviour moving to online and mobile booking

- Operators’ increasing adoption of online booking technology

- OTAs’ efforts to grow their product offerings.

Add to that the pandemic’s pressure, offline bookings have suddenly become a lot less practical. For instance, many attractions now require timed ticketing to comply with safety regulations, and are only taking bookings online.

Travellers also see new benefits to booking ahead online: It ensures access to limited-capacity tours, attractions and activities; and also limits the time spent waiting in lines and engaging face-to-face with operators.

2. Marketing strategies that target locals

The initial early stages of rebound have been, by necessity, locally driven. Domestic visitors will remain key to activity providers’ strategy for at least several months due to both travel restrictions and traveller preferences.

TrekkSoft CEO Olan O’Sullivan says that a prolonged period of dependence on more locally sourced visitors will force tour and activity providers to refine their offerings. “Locals will look for more product differentiation,” he explains. “Building local demand and marketing is a new challenge. Operators need to use this period to get smarter about their products. Locals won’t be interested in something that ten other operators are providing.”

3. Increased interest in direct marketing efforts

Operators say they want more direct bookings and to reduce the influence of OTAs. But if they really want more direct sales, they have to act like it. That means getting their digital marketing house in order. Only when operators take control of their digital presence will they begin to properly control their sales and marketing.

Download the report for a deeper dive into operator marketing strategies and steps operators can take to power their direct marketing strategies.

4. Advanced bookings are becoming more important

Many attractions and operators are implementing new procedures for safety reasons, such as managing capacity by requiring timed entry and advance booking, as well as eliminating paper tickets for a contactless experience.

More than two in five of the top 700+ attractions around the world now require advanced booking online. This rapid shift due to the pandemic will result in lasting change in how travellers purchase their tickets.

5.OTAs are focusing on fewer, better products

In late 2019, TripAdvisor announced that it would separate Viator to operate independently. CEO Steve Kaufer said the newly independent Viator would now focus on helping connect the right traveller to the right options and offers.

Then in June of 2020, Viator announced a new set of standards that would designate products as “Excellent” or “Good,” elevating the visibility of “Excellent” experiences, and possibly removing those that do not meet the requirements for “Good.” Viator also planned to implement a $29 fee to operators to list new products.

Although initially received with confusion and frustration from operators, the strategic intent is clear: after years of trying to make as much product online bookable as possible, Viator is now prioritising profitability over growth, which means deprioritising products that do not perform well on the platform.

6. Growing multi-distribution channel management solutions

Currently, there are a lot of OTAs in the market, each reducing the personal account management offered to operators, replacing it with more automated interaction and support. To expand distribution across the OTA landscape, operators need to learn to navigate an increasingly automated world of interaction.

The rapid increase in the number of distribution channels has also created a new problem for the industry: how to manage all of that connectivity. This is where channel management services come in, providing operators a single point of connectivity to multiple channels. For instance, TrekkConnect, TrekkSoft's own channel manager already has multiple APIs to OTAs, allowing operators to manage multi-channel sales from one platform.

7. Virtual experiences may be a business – for a select few

When the pandemic that brought travel to a near standstill, operators and OTAs quickly pivoted to virtual tours and experiences to connect with customers and raise much needed cash. The results have been mixed, to say the least. Many operators have been experimenting, but relatively few see significant commercial results.

Airbnb is all in with their Online Experiences initiative. As head of Airbnb Experiences for Asia Pacific, Parin Mehta explained, “We wouldn’t undertake it if this couldn’t be a real business.” But he also noted that their virtual roster includes some authentic, very special hosts, including Broadway performers, star athletes, and other celebrities that would be out of reach for small tour and activity operators or other platforms without the scale and resources such as Airbnb has.

Download the report for a deeper analysis into the tours, activities and attractions sector, plus key operator takeaways.